How Do Tax Credits Work For Solar

While it was originally set to expire in 2007 the current federal solar tax credit extension is set to expire in 2022.

How do tax credits work for solar. It s mostly because the solar tax credit has proven to be a highly effective incentive. The federal itc was originally established by the energy policy act of 2005 and was set to expire at the end of 2007. The residential renewable energy tax credit as the irs calls it can be an attractive way to save on the significant cost of installing solar panels or roofing an average sized residential solar. Every state has its own rules for how solar tax credits work.

To claim the credit you must file irs form 5695 as part of your tax return. Thanks to the popularity of the itc and its success in supporting the united states transition to a renewable energy economy congress has extended its expiration date multiple times. Originally established by the epa in 2005 the solar tax credit was supposed to last until the end of 2007. Renewable energy goals the itc has been extended multiple times.

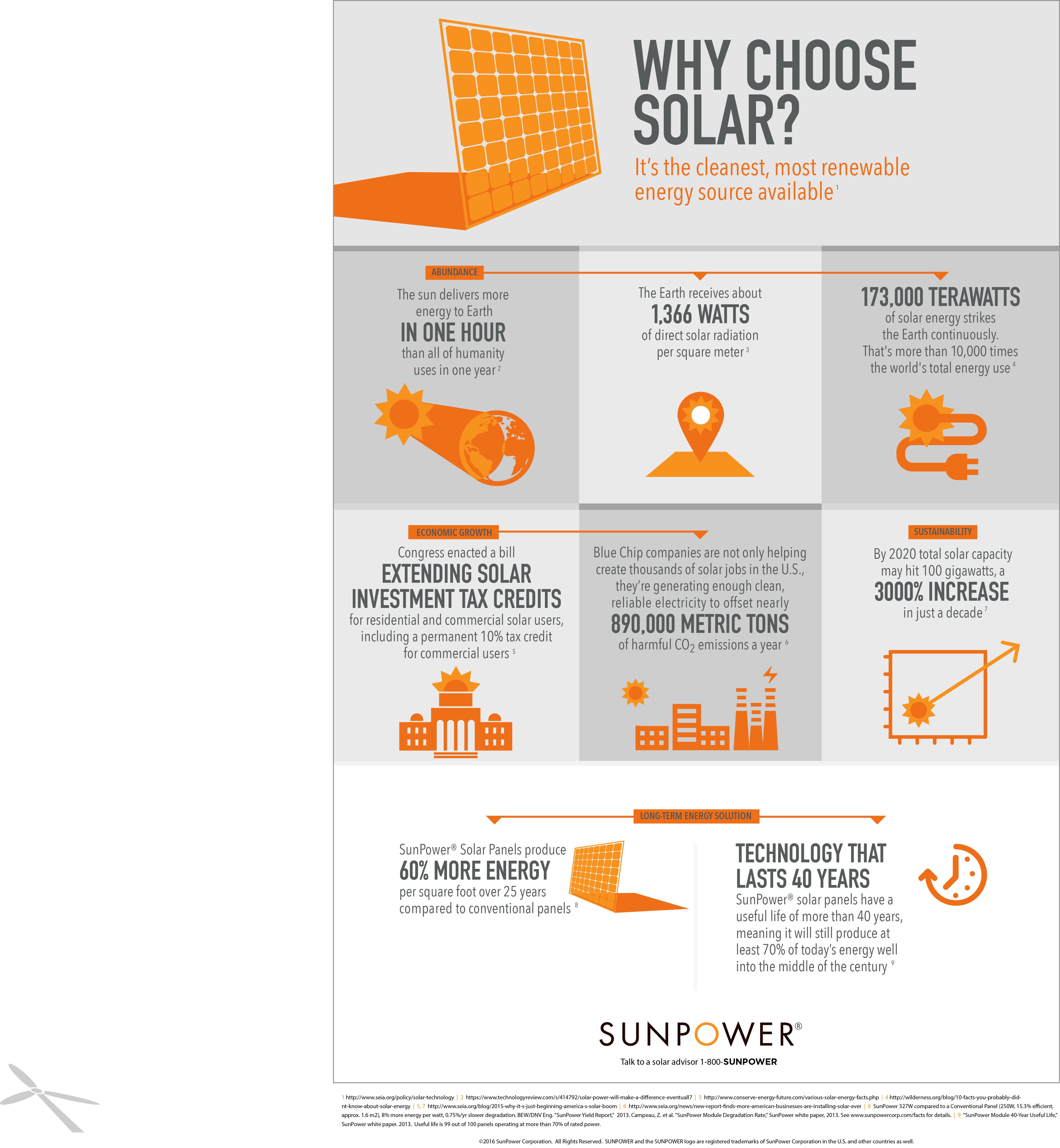

The history of the solar investment tax credit. If you end up with a bigger credit than you have income tax due a 3 000 credit on a 2 500 tax bill for instance you can t use the credit to get money back from the irs. However due to its vast popularity congress has been extending that expiration date for over a decade now. A small history of the solar tax credit.

Some give you a set amount based on your system size i e a certain number of dollars per watt of energy generation capacity and some give you a percentage of the total cost. You calculate the credit on the form and then enter the result on your 1040. How does a solar tax credit work. Filing requirements for solar credits.

Alright now on to what the tax credit does. What does the federal solar tax credit extension mean for the solar industry.